tue 30 August 2022 ▪ 14:00 ▪

5

min reading – per

Of all the fights conducted by the SEC against the American exchanges, there has never been a standing knockout. We have all known a Ripple that has never admitted defeat by the American regulator. For his part, Grayscale displays a good endurance despite his misadventures with this institution. Recently, the digital asset manager has shown that he is not ready to give up the game despite the series of uppercuts issued by the team to Gary Gensler.

Grayscale goes to the rescue of Stellar (XLM), Zcash (ZEC) and Horizen (ZEN)

More and more players in the crypto universe are currently looking at the measures that the SEC will take as part of its aggressive policy towards exchanges. Didn’t we learn at the beginning of this August that she is going to conduct a kind of “witch hunt” to clean up this world with a flourishing future?

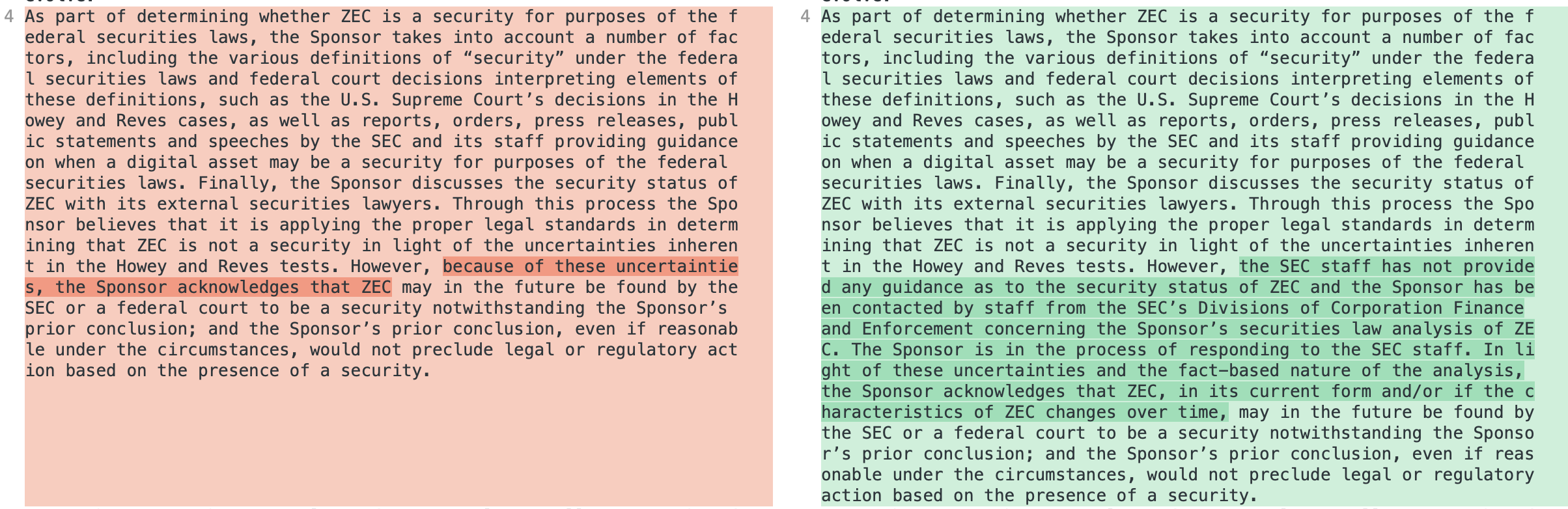

As far as Grayscale is concerned, it’s time for dodging and counterattacks. Reminder of the facts: the US regulator recently questioned the digital currency asset manager about the ” analysis of securities law ” from three less popular tokens. This survey specifically concerns the viability of XLM, ZEC and ZEN. The latter are considered cryptocurrency trusts suitable for brokerage accounts.

As a reply, Grayscale Investment LLC disclosed the actual investigation on the internet. Then the company confessed to responding to members of the SEC’s Division of Corporate Finance in the same document. And finally, she recognized that the ZEC, the XLM and the ZEN ” may currently constitute a security, based on the facts as they exist today ».

Basically, Grayscale intends to take the thorn out of its feet by declaring that these three relatively minor trusts have the same legal status as other securities. So any idea of considering them as securities will be discarded for good.

The SEC never had the last word

We are not unaware that Grayscale already has a history with the Securities and Exchange Commission from the United States. One of the major turns of their exchanges of blows made the front pages of the media last June. At that time, the digital asset manager wiped refusal for its project to transform its GBTC fund, the Bitcoin Trust, into an ETF.

The reason for this rejection? Gary Gensler, the current president of the agency, did not see any digital assets worthy of the status of ” raw materials “apart from bitcoin. It was difficult for him to develop new regulations for a spot bitcoin ETF. In addition, Grayscale had shown no willingness to address the agency’s concerns about market manipulation at the time. So it will be difficult for him to protect investors in this case.

Several crypto investors seemed sickened by this decision. The Grayscale barons subsequently chose the court’s path by filing a petition challenging this SEC decision.

« [La SEC] does not apply consistent treatment to similar investment vehicles, and acts arbitrarily and capriciously in violation of the Administrative Procedure Act and the Securities Exchange Act of 1934 “, hammered Donald B. Verrilli Jr., Grayscale’s senior legal strategist, on occasion.

Moreover, if there are other companies accustomed to lawsuits against the Securities and Exchanges Commission, Ripple is one of them. True, their duel did indeed begin several years ago, but at the moment, the two do not seem to want to give each other a break. At the pace things are going, we can say that the two have drawn.

Conclusion

The SEC may show its claws at cryptocurrency exchanges, but it must also know that on the opposite side, there is no shortage of suitable replicas. Here, the need for an open confrontation against crypto companies can be questioned. Is this the only way to regulate the sector?

Receive a digest of the news in the world of cryptocurrencies by subscribing to our new daily and weekly newsletter service so you don’t miss anything essential Cointribune!

The blockchain and crypto revolution is underway! And the day when the impacts will be felt on the most vulnerable economy in this world, against all hope, I will say that I had something to do with it