The second major evolution of Ethereum is just around the corner. However, it seems to be different from the first. In 2016, the first fork on Ethereum gave birth to ETH and ETC. A first big evolution since these two crypto are currently the 2nd and 19th largest crypto by market capitalization. The second major change will be the potential merger with Proof of Stake. And that could cause another fork. How is this time different, and why DeFi on the new channel could be catastrophic?

Different motivations

First of all, it should be noted that the motivations for these two changes are completely different. Indeed, “the merge” is motivated by an ambitious technological update. While it was a crisis situation that caused the evolution (the fork) of Ethereum in 2016.

- A fork on the Ethereum network duplicates all the data on its original blockchain to the new one. Thus, much more data has passed on Ethereum since this fork.

- Next to that, Ethereum of 2016 was not the great ETH that we know today. Its market capitalization at the time hovered around 1 billion. Whereas today it is more than $ 230 billion.

- During the first evolution, NFTs were not really known to the general public. Today, there are more than 130,000 NFTs on Ethereum.

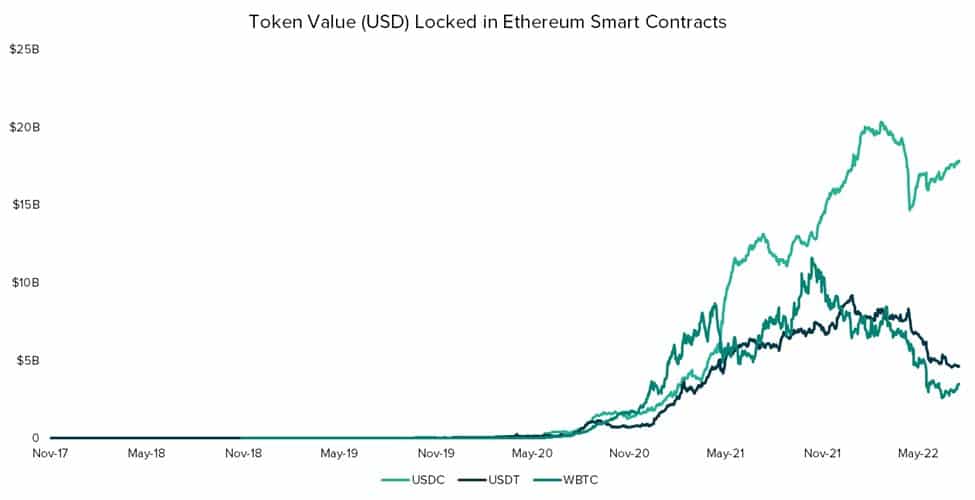

- In 2016, the DeFi was just taking its first steps. While currently, the Ethereum DeFi consists of more than 530 protocols. Smart contracts currently lock up 40 billion dollars on the network ofETH.

Problems related to the new evolution of the Ethereum network

A fork Proof-of-work the current Ethereum network could present significant challenges for developers and market participants. It could also eliminate DeFi on the new blockchain.

In addition, each ERC-20 token is always backed by another asset. Given this, it could be that each ERC-20 stablecoin is no longer tradable by an underlying asset, after the fork. While USDT, for example, accounts for 28% of Ethereum’s market capitalization.Already, some issuers such as Tether and CirclePay have stated that after the fork, only tokens on the PoS network will be exchangeable.

For this purpose, users and smart contracts can try to liquidate positions on the new network. This will thus contribute to increasing the selling pressure on the new token. To all this, technological differences are added. There will probably be a difficult ascent for those who will support Ethereum’s PoW network.

All this shows the difference between the first fork on Ethereum, and “the merge”, the second major evolution of the network. It is indeed much more complex and difficult than it seems. Given all these problems, wouldn’t it be simpler for the protocol team to deploy a new instance of the protocol on ETC? This is another question that arises.

Receive a digest of the news in the world of cryptocurrencies by subscribing to our new daily and weekly newsletter service so you don’t miss anything essential Cointribune!

The Cointribune editorial team unites its voices to express itself on topics specific to cryptocurrencies, investment, the metaverse and NFTs, while striving to best answer your questions.