Even if Nexo seems to be holding up in the midst of a storm of bankruptcies and hacks, the crypto exchange is still dragging a few pans. The former co-founder Georgi Shulev was fired in 2019, he confused his private keys a little from wallets bitcoins (BTC) with those of the company. Apparently in 2019, the KYC was really very flexible and the court had to decide who was the owner of the funds.

September 2019: Georgi Shulev is fired

The editorial staff of Cointribune had unraveled the friendly and family ties of the co-founders of NEXO and it was already not so simple. Finally, friends are no longer really friends : Georgi Shulev was removed from office in September 2019. We understand that he confused the wallets (his own and those of the company). By the way, Shulev asserts without complex (paragraph 109) :

“(i) it was not uncommon to mix personal and business assets in personal accounts, which was the case here ».

Is it useful to comment?

Shulev had retained access to some wallets from the company

The day after his dismissal, Shulev tried to connect to BitMEX where bitcoins (BTC) were kept. Too late to clear the accounts. Nexo, here one of the subsidiaries of NEXO GROUP based in the Cayman Islands, had also contacted BitMEX. In a very detailed court report, Nexo and Shulev are vying for ownership of the wallet which contains 880 bitcoins (BTC). The estimate in June was 30 million pounds sterling. 1451,028 bitcoins had been deposited in May 2019 on a company account: a few bitcoins must have been lost along the way. Other digital wallets are also in Shulev’s possession.

Who are bitcoins (BTC) for?

A first bizarre agreement is reached in 2021: Shulev must return the keys to the wallets in exchange for a million dollars. Since the two parties do not trust each other, the muddle continues. Shulev owns nine other assets, the details of which are listed in the report. These assets come from Nexo accounts from Binance, Kraken and Huobi. In the meantime the accounts are frozen: in full bearmarket, and with its fixed assets, Nexo estimates the loss at $7.9 million. Between November and July 2022, bitcoin rose from $69,000 to $17,500, while ether (ETH) plunged from $4,850 to $875.

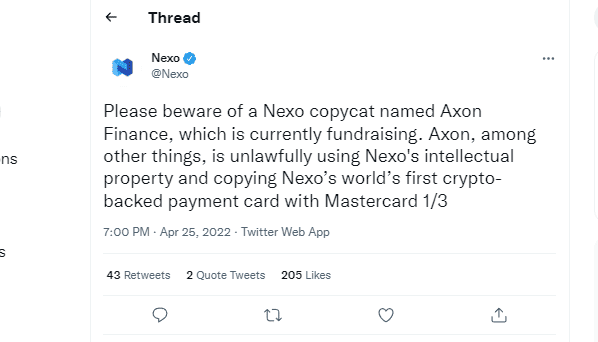

Shulev, already CEO of Finblox Ltd, created AXON

We better understand this angry email from NEXO (above) … Georgi Shulev must therefore receive $ 1,000,000.00 in USDT and NEXO Tokens. For his new business?

The judge finally considered that the wallets had been opened on behalf of Nexo to take advantage of the spreads between the exchanges. So Nexo wins the game, but Shulev gets away with a kind of golden parachute. However, he “picked a little” from the crate.

Nexo has confirmed that it has recovered 871.5 bitcoins on the BitMEX account on August 17, 2022. Nexo should also pick up the other 9 wallets containing various cryptocurrencies.

For English-speaking lawyers, here is a link that explains the disputes between Shulev and Nexo in detail.

Things are happening within the exchanges … The leniency with regard to the embezzlement of funds by Shulev, who does not hide it, is astounding. No investigation is being carried out to verify Nexo’s accounts either. It seems normal to mix your personal accounts and those of the company (therefore customers). Not being a lawyer, I have the impression that something is escaping me.

Receive a digest of the news in the world of cryptocurrencies by subscribing to our new daily and weekly newsletter service so you don’t miss anything essential Cointribune!

Subprime, financial crises, rampant inflation, tax havens… Bitcoin was designed for more transparency and maybe finally change the game. I am trying to understand this new environment and trying to explain it in my turn. The road is undoubtedly long, but it is worth it.