The UAE has long been a significant hub for institutional trading, attracting asset managers, hedge funds, and corporate entities seeking efficient and secure platforms. Among the major players in the region is ADSS, a broker offering tailored services designed to meet the demands of institutional clients. This comprehensive review dives into the specific ways in which ADSS supports institutional trading, from its robust infrastructure to regulatory compliance and specialized customer service.

Advanced Trading Infrastructure

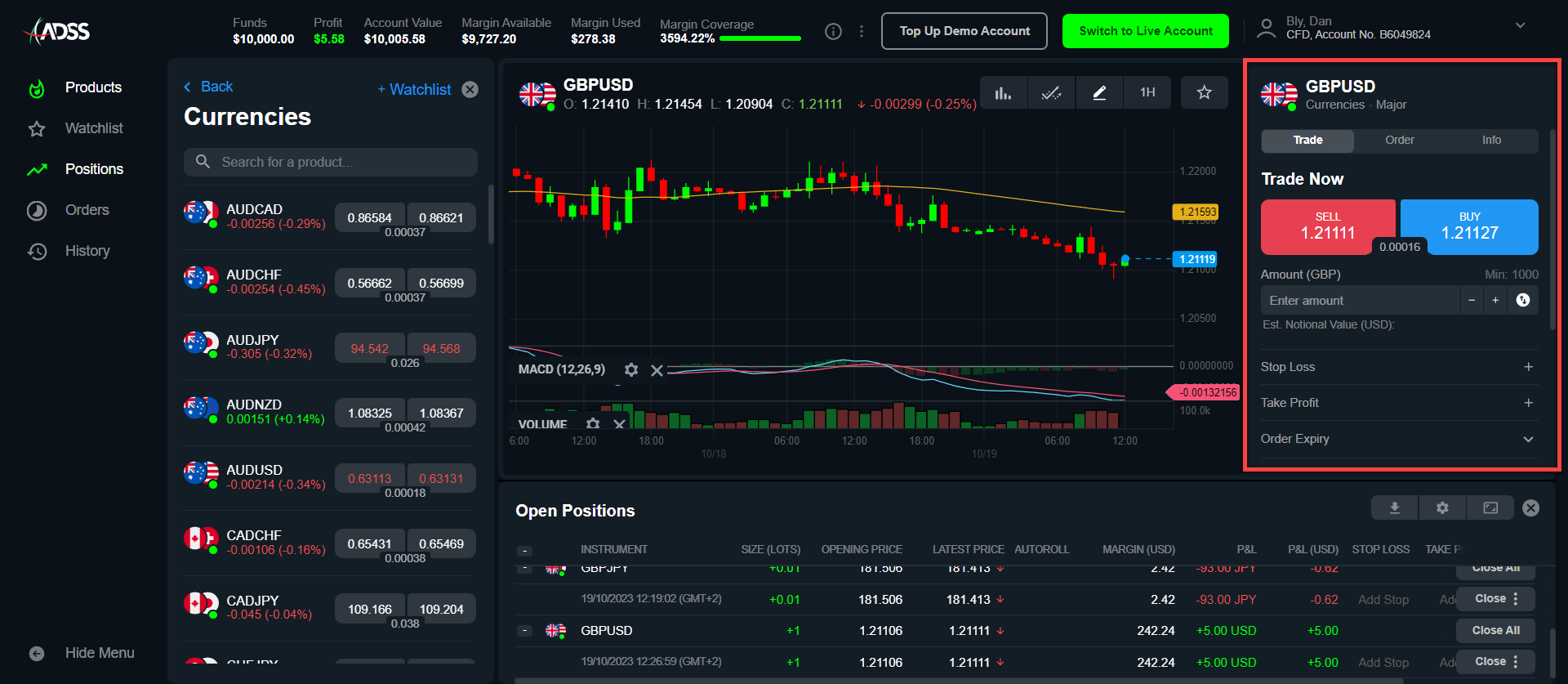

ADSS offers a sophisticated trading infrastructure that includes industry-standard platforms like MetaTrader 4 (MT4) as well as its proprietary ADSS Trading App, each equipped with features geared toward institutional needs.

The ADSS App is well-suited to high-frequency trading (HFT) and complex algorithmic strategies, which many institutional clients depend on. The platform’s real-time data feeds and customizable interfaces allow clients to create and execute multi-layered strategies efficiently.

ADSS provides FIX API connectivity, allowing institutional clients to integrate directly with ADSS’s system for faster and more flexible trading. This connectivity is essential for institutions that rely on direct market access (DMA), enabling them to send orders directly to the exchange or liquidity provider. Such infrastructure supports large-scale, automated trading strategies while ensuring speed and security.

Deep Liquidity Pools and Market Access

Institutional clients require extensive market access and deep liquidity to execute large trades without significantly impacting market prices. ADSS delivers both through its network of top-tier liquidity providers.

ADSS partners with major banks and liquidity providers to create a comprehensive liquidity network. This aggregated liquidity allows institutional clients to execute large orders with minimal slippage, even during periods of market volatility. By consolidating liquidity from various sources, ADSS provides institutional clients with competitive pricing and reliable execution.

Institutional clients benefit from access to a broad range of asset classes on the ADSS platform, including forex, commodities, indices, and more. This variety allows asset managers and hedge funds to diversify their portfolios or develop multi-asset trading strategies without needing multiple platforms.

ADSS’s infrastructure includes a deep order book, providing institutional clients with greater market visibility and the ability to analyze supply and demand dynamics. This market depth is especially useful for those seeking precise control over their trade executions or looking to assess liquidity before entering a position.

Risk Management Solutions

Institutional clients face unique risk factors, and ADSS offers tools that help them mitigate these risks effectively.

ADSS’s risk management suite includes options for setting stop-loss orders, monitoring margins, and establishing exposure limits. These tools are essential for institutions managing complex portfolios and high-value trades, as they provide the necessary controls to mitigate risks in real-time.

ADSS also provides hedging options tailored to institutional clients, allowing them to offset exposure and protect against adverse price movements. These strategies are customizable to meet the specific risk profiles of different institutional clients, ensuring that each firm has the flexibility needed to adapt to changing market conditions.

Dedicated Institutional Client Support

Institutional clients require a higher level of support than retail traders, and ADSS delivers with dedicated account management and specialized technical assistance.

Each institutional client at ADSS has access to senior account managers who understand the unique demands of large-scale trading. These managers provide strategic insights, answer complex queries, and offer real-time assistance for urgent matters, creating a high-touch service that caters to the professional needs of institutional clients.

Technical support is available around the clock, addressing platform-specific issues such as API integration and customization. The support team is experienced with the technical complexities of institutional trading and can assist with everything from troubleshooting to optimizing performance for high-frequency strategies.

Regulatory Compliance and Security

In the UAE, ADSS’s compliance with local laws and data security protocols is crucial.

ADSS operates under the supervision of the Central Bank of the UAE and is regulated by the SCA, ensuring adherence to stringent regulatory standards. This compliance reassures institutional clients of the broker’s commitment to maintaining ethical and legal standards, a critical factor for firms needing to meet both local and international regulatory requirements.

To protect sensitive data, ADSS employs robust security measures, including encryption and cybersecurity protocols. Institutional clients can feel confident that their information is safeguarded, reducing the risk of data breaches and unauthorized access.

Pricing and Cost-Effectiveness

Competitive pricing is essential for institutional clients, and ADSS’s fee structure is designed with cost efficiency in mind.

ADSS offers a tailored fee structure for institutional clients, including competitive spreads and commission options. This flexibility in pricing allows clients to choose a cost structure that aligns with their trading volume and strategy.

Compared to other brokers in the UAE, ADSS’s pricing is competitive, particularly for high-frequency and large-volume trading. By offering competitive spreads and commission rates, ADSS makes itself an appealing choice for institutions seeking cost-effective trading solutions.

Conclusion

ADSS provides institutional clients in the UAE with a robust suite of trading tools, dedicated support, and secure, compliant infrastructure. Its commitment to competitive pricing, high liquidity, and regulatory compliance makes it an ideal choice for asset managers, hedge funds, and corporate entities seeking an efficient and reliable trading partner. For institutions looking to trade effectively in the UAE, ADSS stands out as a trusted option that meets the complex needs of the professional trading community.